We offer ongoing financial planning and investment management for a flat fee. Our flat fee is not tied to the size of your investment portfolio like the typical 1% "assets under management" (AUM) fee, meaning that you won't pay more just because you saved more. It’s transparent, predictable, and, most importantly, fair.

Ongoing Financial Planning & Investment Management

Our ongoing financial planning and investment management service begins with defining your purpose and creating your initial plan. Your financial purpose will be the basis for our conversations and financial decision-making.

As your life evolves, financial markets shift, and tax legislation changes, we will adjust your financial plan as needed.

Our ongoing financial planning and investment management service includes:

Retirement Projections: Planning your retirement timeline, including early retirement options.

- Investment Management: Ongoing management of your investment portfolio based on a low-cost passive strategy (no active trading or high-cost funds).

- Investment Strategy: Selecting an appropriate investment allocation, utilizing tax efficiency and diversification.

- Retirement Spending Plan: Creating a sustainable spending strategy for retirement.

- Portfolio Withdrawals: Annual strategies to identify which accounts to withdrawal from and optimize withdrawals to limit taxes.

- Roth Conversion Analysis: Assessing tax-saving opportunities through Roth conversions.

- Tax Planning: Strategies to minimize taxes and increase retirement income.

- Social Security Timing: Determining the best time to start benefits.

- Pension Elections: Guidance on selecting pension options.

- Estate and Beneficiary Planning: Reviewing/obtaining estate documents and aligning beneficiaries.

- Charitable Giving: Planning tax-efficient donations.

- Health Insurance & Medicare: Navigating coverage options for your needs.

- Insurance Planning: Ensuring proper protection for your financial future.

- Legacy Planning: Defining and implementing your long-term wishes.

Flat Annual Fee $12,000*

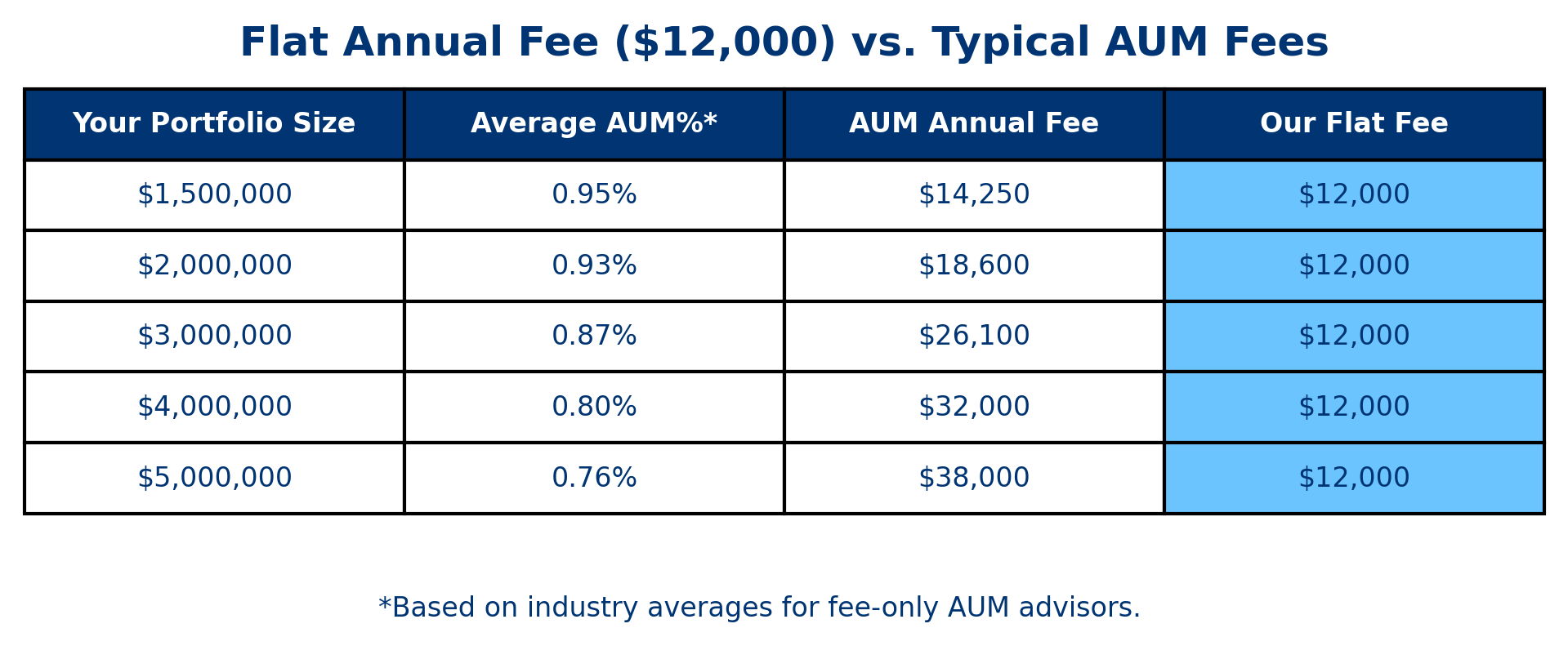

We charge a flat annual fee that’s not tied to the size of your investment portfolio. Many advisors use an “assets under management” (AUM) fee, typically starting around 1% of your portfolio each year, depending on portfolio size. That means the larger your portfolio, the higher your fee, even if the service you receive is no different from someone with fewer assets.

In reality, the effort required and value delivered to plan for a family with $1,000,000 versus $5,000,000 are often quite similar. So why should you pay more just because you’ve saved more?

Our flat-fee structure ensures you get exceptional value without unnecessary costs. It’s transparent, predictable, and, most importantly, fair.

The table below outlines typical annual fees under the traditional assets under management fee model to illustrate how our flat fee retirement planning and investment management compare.

*In cases of higher financial complexity, a higher fee may apply. Your final fee will be quoted after an introductory call and a review of your financial situation and planning needs.

Financial planning is an ongoing process and a partnership. After implementing your initial financial plan, we will maintain a close and proactive planning relationship. Our goal is to remain in your corner and provide comfort and confidence so you can live your best life through retirement.

We typically have three meetings per year to review your plan, assess your annual spending needs, design your portfolio withdrawal strategy, create your yearly tax planning strategy, and discuss anything on your mind. Outside of our typical reviews, we are available for additional meetings as needed and are always accessible by email and phone. We are here for you as life happens and will never limit our interactions!

One-time Retirement Plan

We offer one-time retirement plans on a limited basis. Our one-time plan service may be a good fit for individuals and families interested in one-time advice on their situation and who are comfortable implementing planning recommendations independently. A one-time plan may be a good fit if you are:

- Still working and want to assess your preparedness to retire

- Transitioning into retirement and want to create a retirement strategy

The fee for a one-time plan starts at $5,000 based on the number of topics covered and the complexity of your situation.

*One-time plans are offered on a very limited basis.